China Can’t Seem to Stop Bitcoin Mining

Hashprice and mining company woes

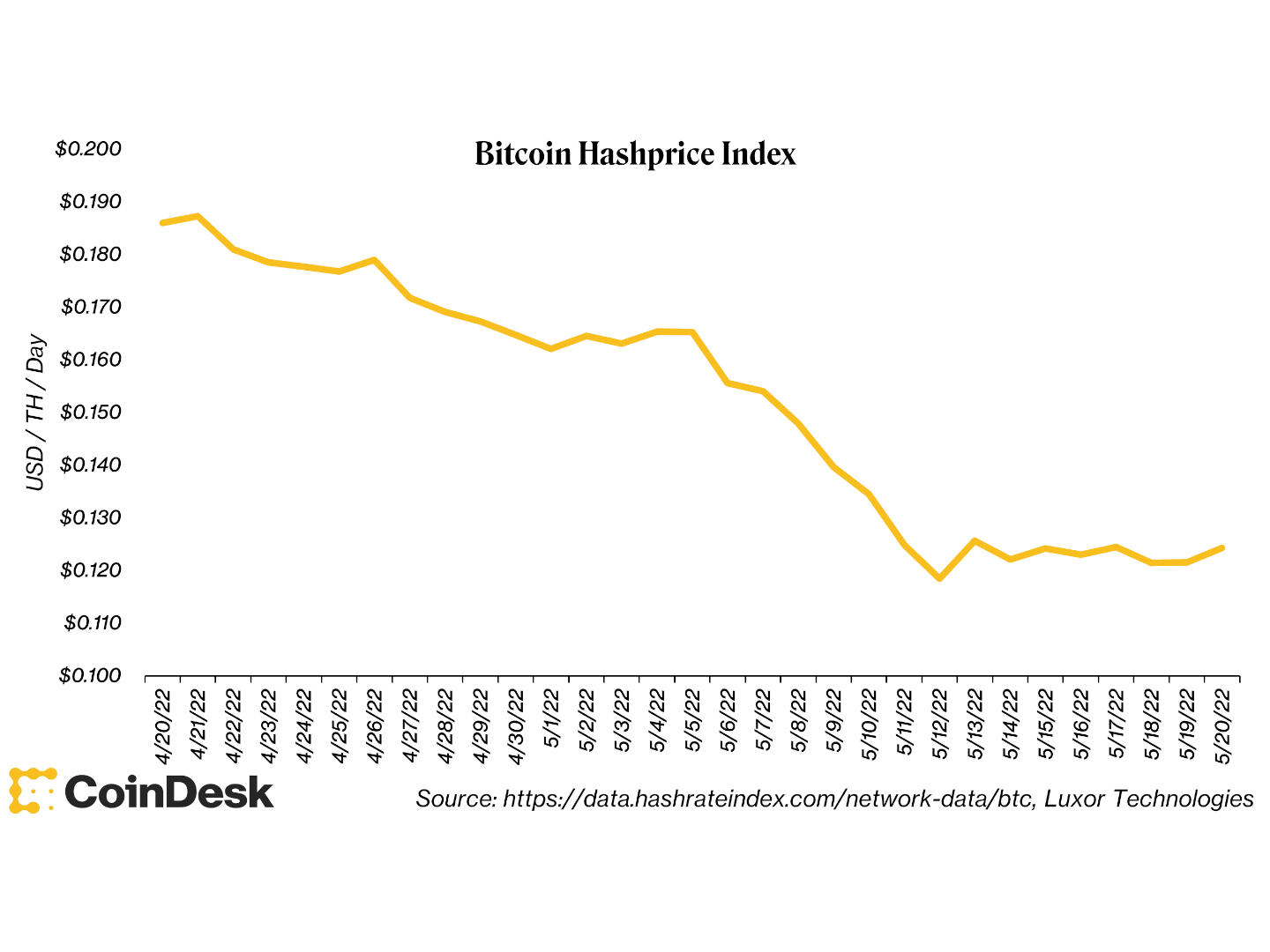

Amid falling bitcoin prices, there is also some concern around bitcoin miners and their profitability. There is a metric developed by Luxor Technologies called hashprice which represents the expected value of mining. Hashprice is expressed as a dollar per terahash per day, a terahash being the computational power provided by mining equipment. Here is how the last month has fared for hashprice.

Hashprice has trended down due to 1) the USD price of bitcoin falling, 2) more miners coming online and 3) the subsequent increased network difficulty (the network adjusts how hard it is to mine roughly every two weeks, based on the amount of active mining power). Not exactly rosy, but it makes sense. And the decline is acting as a forcing function for mining operators to buckle down or shut down. Many industry practitioners are warning that this is the time when “only the strong will survive.”

In theory, miners turn off their machines whenever bitcoin prices drop significantly, and it becomes unprofitable to keep them running. This time, even though hashprice has decreased, we haven’t seen this sort of drop off, and we have the public mining company filings to prove it. Public miners have all publicly repped to something along the lines of, “We are mining bitcoin, we want to mine more bitcoin, we are going to hold as much of the bitcoin we mine as possible and we’re going to use other sources of capital to fund operations and growth.”

That could be fine, but as these miners feel more pressure, there are potential obligations to capital providers they might have to answer to. On top of that, if the market gets worse, these companies may need to do something, like start selling their bitcoin. These aren’t companies with the balance sheets of Apple or Google; they more closely resemble startups that happen to trade on the public markets.

All said, there is no particular reason to worry about the mining industry as a whole. Bitcoin mining will be fine, but the cast of characters might change since the capital markets are available up until the moment they aren’t. Bitcoin will be better for it, but there might be some pain coming at the company level.