TICK TOCK

Siyata (NASDAQ:SYTA) is giving Investors and Traders $160 million reasons to take a Core position

Ticker: (NASDAQ:SYTA)

Core Gaming is about to go Beast Mode, as the merger could close anytime!

Without warning!

The last time I featured (NASDAQ:SYTA) the stock hit a high of $9.60

What’s changed?

Nothing except now the merger seems to be imminent and (NASDAQ:SYTA) is back in extreme value territory.

When Siyata originally announced the Core Gaming merger, SYTA shot up to $9 the same day and a few weeks ago the Core Gaming AI COMIC news fueled a rally that passed the $9 level.

So, if the past two Core Gaming merger driven runs are an indicator, it appears that a SYTA run to the $9 range should be a gimme.

Considering that the merger close will be way bigger news than those two combined and it could close anytime, that’s the formula for quick and easy money for nimble traders.

However, Core Gaming and its profit churning A.I. gaming platform will likely motivate some smart traders to take some profits on the next strong run, while letting the rest ride the wave.

Core Gaming has proven that it can bootstrap its growth, so chances are it will efficiently turn its new Nasdaq listing capital access into impact capital and the expected slew of announcements that should follow the turbocharging of Core Gaming’s business model, following the merger’s completion, with Core Gaming’s proven CEO takes the reigns of the newly combined companies, should be more powerful than what we witnessed last month.

If Core (SYTA) just Grows from 40M to 50M MAUs and a margin of 15% on revenues of $150-200M, that should see Core Gaming (SYTA) hit a more than $1.8 -$2.4 Billion valuation.

Some of you will do the math on this and quickly see these realistic figures are likely scenarios based on today’s market environment.

SYTA is back in the accumulation phase and, once the merger closing is announced, we could see a similar parabolic upside move.

We have been covering the company since the February merger press conference announcement and have alerted investors too many times to list.

This will likely be your only chance to not chase (SYTA) the day of the closing.

Siyata (NASDAQ:SYTA) lined up a merger that ValueScope, a Mashall & Stevens company, which is considered to be the “gold standard” in acquisition evaluations, pegged at $160 million.

Core Gaming, which creates free-to-play (F2P) games for mobile devices, boosting more than $80 million in 2024 revenue. Despite the merger distraction, the combined company plans on hitting $100 million in 2025 revenue and being profitable. With more than 700 million downloads and 43 million MAUs (monthly active users), that may be a cakewalk.

They quickly grew 3 million MAU’s from just November to April.

Core gaming builds and markets its games from its A.I platform, so they not only know what games you’re playing, but which games you’ll likely play next.

The Value Scope report had some killer information in it, but the most important information in the report was how it valued the company.

Valuation Comparisons:

ValueScope and Market Multiples

ValueScope’s April 10, 2025, report pegs Core Gaming’s enterprise value at $185.9 million

While that’s impressive, they are forecasting CORE gaming will do $240 million in 2026 revenue with a $722.4-$936.2 million valuation at a 3-4X EV/Sales multiple, which is aligned with peers like Applovin (NASDAQ:APP) and Electronic Arts (NASDAQ:EA)

APPLovin, which collaborates and competes with Core Gaming, shows you what can happen when you have the perfect storm of a Bull Market, a Hot sector, and over confident short sellers.

A more than 1150% gain off the highs with the stock swinging wildly as the battle rages on.

I’ve included a slide of some pricing scenarios based on the merger math which was agreed to in the formal document and remains constant. Siyata shareholders will retain a minimum of 10% of the merged entity.

With access to the public markets, it feels like the ValueScope report is too conservative.

Other Gaming companies like Zynga pre acquisition and Playtika in their growth phase had an 8-10X price to sales, which would make Core Gaming fetch a $1Billion plus market cap by 2025*

4 Price Scenarios: The Math of Big Wins

Assuming ~10 million fully diluted (NASDAQ:SYTA) shares and Core Gaming’s $160 million valuation, across all three 10-day VWAP scenarios at the record date, the valuation models are as follows:

What happens if SYTA trades flat or choppy to a 10-day VWAP of about $2, on the record date?

Calculation:

$160M ÷ $2 VWAP = 80M

shares to Core Gaming and SYTA’s 10M shares would mean that legacy SYTA shareholders own over 10% of the 90M combined shares.

Impact:

$850M ÷ 100M shares

*Assuming 10M shares issued for future funding or acquisitions.

Could grow to $8.50 to be in line with ValueScope’s projections.

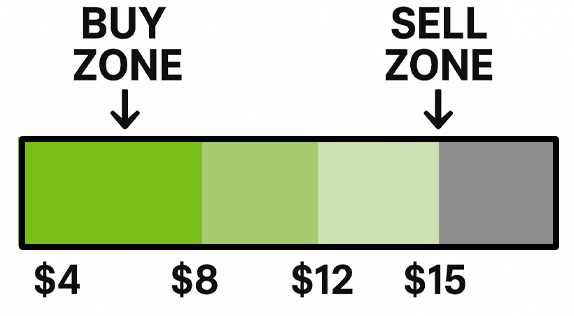

What happens if SYTA trades higher to a 10-day VWAP of about $4, on the record date?

Calculation:

$160M ÷ $4 VWAP = 40M

shares to Core Gaming and SYTA’s 10M shares would mean that legacy SYTA shareholders own 20% of the 50M combined shares.

Impact:

$850M ÷ 47M shares

*Assuming 7M shares issued for future funding or acquisitions.

Could grow to $14.90 to be in line with ValueScope’s projections.

What happens if SYTA trades higher to a 10-day VWAP of about $8, on the record date?

Calculation:

$160M ÷ $8 VWAP = 20M

shares to Core Gaming and SYTA’s 10M shares would mean that legacy SYTA shareholders own 33% of the 30M combined shares.

Impact:

$850M ÷ 34M shares

*Assuming 4M shares issued for future funding or acquisitions.

Could grow to $25.00 to be in line with ValueScope’s projections.

What happens if SYTA trades lower to a 10-day VWAP of about $1, on the record date?

Calculation:

$160M ÷ $1 VWAP = 160M

shares to Core Gaming and SYTA’s 10M shares would mean that legacy SYTA shareholders own less than 10% of the 170M combined shares, so the record date legacy shareholders would receive a special dividend in the form of approximately 80% more shares per record date share. In other words, for every 1,000 record date shares, those legacy shareholders will receive an additional 800 shares six months after the record date and that’s the case for all legacy record date shareholders, whether you own ten shares or ten thousand shares.

Impact:

$850M ÷ 193M shares

Assuming 15M shares issued for future funding or acquisitions.

Could grow to $4.40 to be in line with ValueScope’s projections, but the 80% dividend would translate to a $7.92 presplit value.

Please keep in mind that we’re using ValueScope’s more conservative numbers, but, remember, if Core (SYTA) just Grows from 40M to 50M MAUs and a margin of 15% on revenues of $150-200M, that should see Core Gaming (SYTA) hit a more than $1.8 -$2.4 Billion valuation, which would more than double these projections.

The mobile gaming industry is not just growing, it’s outperforming.

According to the latest industry data:

- Mobile games now account for nearly 50% of total gaming revenue.

- Smartphone gaming alone is expected to hit $181.9B to $342.2B by 2030.

- The market is driven by the F2P model, cloud gaming, and AI—areas where Core Gaming is heavily invested.

Investors love these dynamics.

That’s why mobile-first companies command high earnings multiples:

- Tencent trades at a forward P/E > 30x, driven by mobile dominance.

- Playtika and Glu Mobile saw IPO valuations based on 5–10x sales even with modest profit margins.

- Hedge funds and strategic buyers alike are actively accumulating positions in mobile-first firms.

Given these trends, Core Gaming’s upcoming move onto Nasdaq (NASDAQ:SYTA) is well-timed, aligning investor appetite with growth-stage execution.

We are in the second quarter and running out of trading days….It’s time to trade into the upcoming catalyst now.

This stock is volatile and moves quickly, when news breaks it’s best to already have a position.

Remember, use a trading strategy, stop losses, and many things in the stock market can be true at the same time. Pay attention.

Do yourself a favor and sign up to receive breaking news Alerts so you don’t miss out on updates about Siyata.

IMPORTANT DISCLAIMER AND DISCLOSURE

This communication is a paid advertisement issued by 24/7 Market News Inc. (“247”), which owns and operates 247marketnews.com. This is not a recommendation to buy or sell securities and should be viewed strictly as a promotional communication. 247 is a third-party marketing and media provider that is not registered as an investment advisor, broker-dealer, or dealer in securities in the United States or Canada. 247 is not licensed with the Securities and Exchange Commission (SEC), the British Columbia Securities Commission (BCSC), the Canadian Securities Administrators (CSA), FINRA, or any other regulatory body. 247 has received, and expects to receive, twenty thousand United States dollars per week from MicroCap Advisory on behalf of Siyata to publicly disseminate information and promotional content related to the company SYTA. This compensation represents a direct conflict of interest, as 247 is being paid to publish positive coverage of the featured company. Readers should assume 247 has a financial relationship with the company or its shareholders. 247’s editor holds no stock in SYTA and will not buy or sell shares for at least 72 hours after publication. This publication is intended solely for informational and marketing purposes. It is not, and should not be construed as investment advice, an offer to sell or a solicitation to buy any security, or a recommendation to engage in any investment strategy. All readers are strongly urged to perform their own due diligence and consult with a licensed investment advisor, broker, or other qualified financial professional before making any investment decision.

Forward-Looking Statements

This release contains “forward-looking statements” as defined under applicable Canadian and U.S. securities laws, including Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include words such as “expects,” “intends,” “plans,” “believes,” “seeks,” “may,” “should,” “estimates,” “anticipates,” and similar expressions. These statements are subject to significant risks and uncertainties that may cause actual results to differ materially. These risks may include, without limitation, operational risks, market conditions, regulatory developments, or management’s ability to execute its business strategy. You are cautioned not to place undue reliance on such statements. Forward-looking statements are made as of the date of this publication, and 247 undertakes no obligation to update or revise them.

Accuracy and Source of Information

All information contained in this communication has been sourced from publicly available information believed to be reliable, but no representation or warranty, express or implied, is made as to its accuracy or completeness. The content is editorial in nature and represents the personal views of the author. It has not been reviewed or approved by the featured company.

Legal Protections and Editorial Rights

This communication is protected under the First Amendment to the United States Constitution as well as applicable Canadian freedom of expression laws. For reference on financial commentary protections, see Lowe v. SEC, 472 U.S. 181 (1985).

Investing in securities, especially low-priced or microcap stocks, involves significant risk. You could lose your entire investment. This communication should not be the basis for any investment decision.

For official filings by publicly traded companies, visit:

• U.S.: www.sec.gov

• Canada: www.sedarplus.ca

DISCLOSURE: 24/7 Market News Inc. (247), owns and operates 247marketnews.com is a third-party publisher and news release service provider which disseminates corporate news electronically through multiple online media platforms. 247 is NOT an affiliate with any of the companies mentioned in our reports. 247 is a news distribution service and is not registered with FINRA or any other professional licensing service. 247 is not an analyst, broker dealer or advisor, and holds no such licenses. 247 may NOT offer to buy, sell, or hold any security. 247 Venture Beats, and Breakfast bits and any other corporate profiles will NEVER be a solicitation or recommendation of any kind, of any security mentioned.The materials in all our releases are intended to be for informational purposes only and should never be considered research or due diligence on any company mentioned. All readers are encouraged to perform standard due diligence by reading the company’s filings at SEC.gov. Readers should consult their broker or licensed professional before investing in any company. All materials in this release are based on publicly available statements made by the companies. 247 is not liable for any investment decisions made by any readers or subscribers. Any investment could result in you losing all your money from investing in any stock. 247’s editor owns no shares of $SYTA and will not trade in the stock. 24/7 will also be using financial marketing tools and platform. Editors are paid to put a best-case scenario profile out to the investing public. This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”.You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements.You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and 247 undertakes no obligation to update such statements. All information, opinions, analyses, technical analysis, trading price targets, and support and resistance interpretations presented in this publication represent the author’s personal views and are fully protected under the First Amendment of the United States Constitution. The content provided herein is intended solely as editorial opinion, general market commentary, or educational material, and should never be construed as financial or investment advice. This publication does not constitute a solicitation or recommendation to buy or sell securities, commodities, or any other financial instruments. Readers are strongly advised to conduct their own independent research or seek professional advice before making any investment decisions. For additional information regarding First Amendment protections for financial newsletters and commentary, please refer to Lowe v. SEC, 472 U.S. 181 (1985): https://supreme.justia.com/cases/federal/us/472/181/

Copyright © 2025 24/7 MarketNews