Get Ready, Investors, the Digital Ad Gold Rush is here and Totaligent is Positioned for Explosive Gains!

Investment Snapshot

Ticker: (OTCID:TGNT) ![]()

Stock Price

$0.03

Common Shares Out est.

211 Million

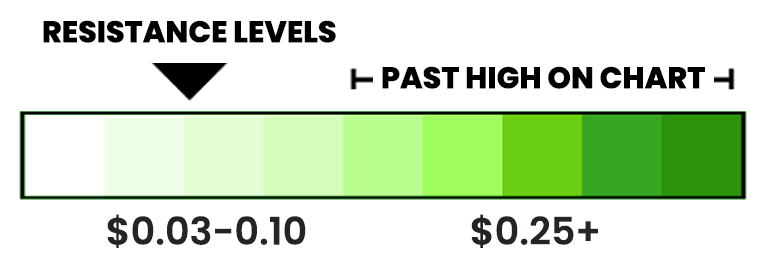

Long Term Target*

$0.25+

Short Term Target

$0.10

Exchange

OTC MARKETS

Current Share Price: Trades on OTC markets below $0.03

Target Valuation (Near-Term): $0.03-0.10/share

Editors Note: The chart shows 2 big trading days stopped out at .11 and then .19 both during 2021*The stock has been quiet since then as Totaligent has been mostly in development.

RISK: Company fully reporting, approved S-1, but OTC markets and carries all associated inherent risks.

Catalysts:

Announcements of updates to software.

Pre-Public BETA

Public BETA LAUNCH

Onboarding Clients

Revenues and Earnings

Possible Acquisitions.

TGNT is Democratizing Digital Marketing for the Masses in a $900 Billion Boom!

Totaligent (OTCID:TGNT) is Democratizing Digital Marketing and the Movement should place the power of Digital Marketing in the Hands of Millions of new Advertisers.

Weve all seen how explosive companies trading for pennies can be. One catalyst, a platform update, a public beta launch, fresh customer wins, or even a single earnings announcement can send shares doubling, tripling, or more in a heartbeat. That’s the power of volatility. However, remember: volatility cuts both ways. Which is why the real money is made by those who plant their flag before news announcements send in the crowds of traders.

In a world where digital marketing isn’t just an option, it’s the oxygen for business survival, TGNT is storming the gates as the ultimate disruptor.

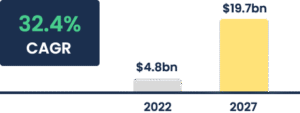

Picture this: A $667 billion global digital advertising market in 2024, exploding to over $900 billion by 2027 at a blistering 9.2% CAGR, according to Statista, with much of this growth due to new advertisers who need a hand.

These newbies are also helping to fuel e-commerce’s relentless surge (projected to hit $8.1 trillion globally by 2026), the proliferation of connected devices (over 18 billion by 2025), and AI’s hyper-personalized targeting revolution, this isn’t growth, it’s a tsunami.

Yet, amid this frenzy, it’s like the legacy platforms are rigged against you: Opaque black boxes sucking up budgets with zero accountability.

Enter TGNT: The fierce, user-first platform flipping the script, empowering millions, from scrappy startups to global brands, to unleash digital marketing’s true power while limiting waste, Frustration, and adding ROI

Digital Marketing is the Key to Business Success, yet other Digital Ad Platforms set up their Users to Fail

“Necessity is the Mother of Invention” is a proverb that first appeared in English in 1519 (in slightly different form) and still holds true more than 500 years later, especially for Totaligent.

You see, advertising and marketing have drastically changed over the past 25+, since we first started, and digital marketing is where it’s at now.

During that timeframe, we poured millions into digital campaigns, dissecting every click, conversion, and catastrophe. What we uncovered? A rigged casino where Big Tech’s “Vegas-style psychoanalytics” prey on advertisers, designed to inflate spend while delivering diminishing returns. Big Marketing’s inefficiencies aren’t bugs; they’re features. Platforms hoard your data, throttle transparency, and prioritize their profits over your ROI.

We’ve seen it firsthand: Even as a “preferred” advertiser with seven-figure budgets, we battled bots, fake clicks, shadowy algorithms, and bad actors who turned our dollars into digital dust.

The stats are staggering, and infuriating. Up to 40% of mobile ad clicks are fraudulent, siphoning $5.8 billion in losses by end-2024 alone, per Juniper Research, with projections ballooning to $170 billion by 2028. Over 50% of users wield ad blockers, nuking 52% of Meta Ads clicks as fraud in 2024, according to industry watchdogs. And get this: 60% of directory searches fizzle without a single click, leaving marketers chasing ghosts in a post-search world dominated by AI chatbots and privacy crackdowns (hello, Apple’s email pixel blocks and GDPR’s iron grip).

Small businesses? They’re hit hardest, 30% of their ad spend vanishes into fraudulent black holes. No wonder trust is in the toilet: Agencies and platforms refuse to evolve, leaving advertisers frustrated, budgets bloated, and results lackluster

We also watched lesser companies with inferior tech get acquired for billions and the result only exacerbated the core problems plaguing the digital ad industry.

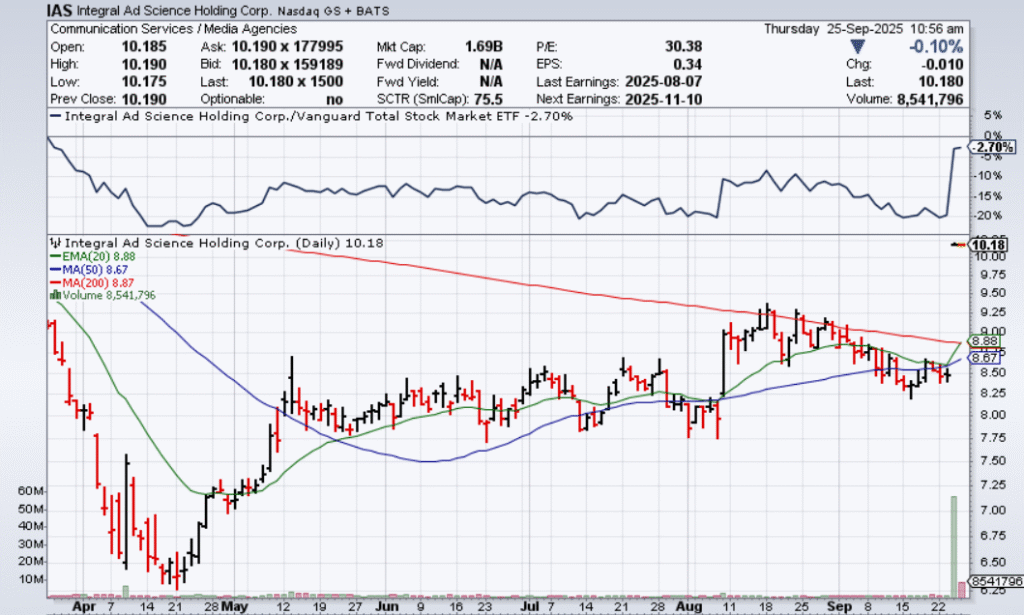

If IAS Is Worth $1.9 Billion,

What’s Totaligent Really Worth?

The digital advertising world just got another billion-dollar jolt. Integral Ad Science (NASDAQ:IAS), a leader in media measurement and ad fraud prevention, is being acquired by private equity firm Novacap for a cool $1.9 billion, or $10.30 per share, a 22% premium to its last close. The deal comes as IAS continues to scale its AI-first verification platform across global media buys, with Q2 revenues already topping $150 million.

IAS’s deal is just the latest in the $50 billion M&A adtech wave, fueled by AI-driven fraud battles (40% of mobile clicks are fake). “This acquisition underscores confidence in our growth trajectory,” their release noted.

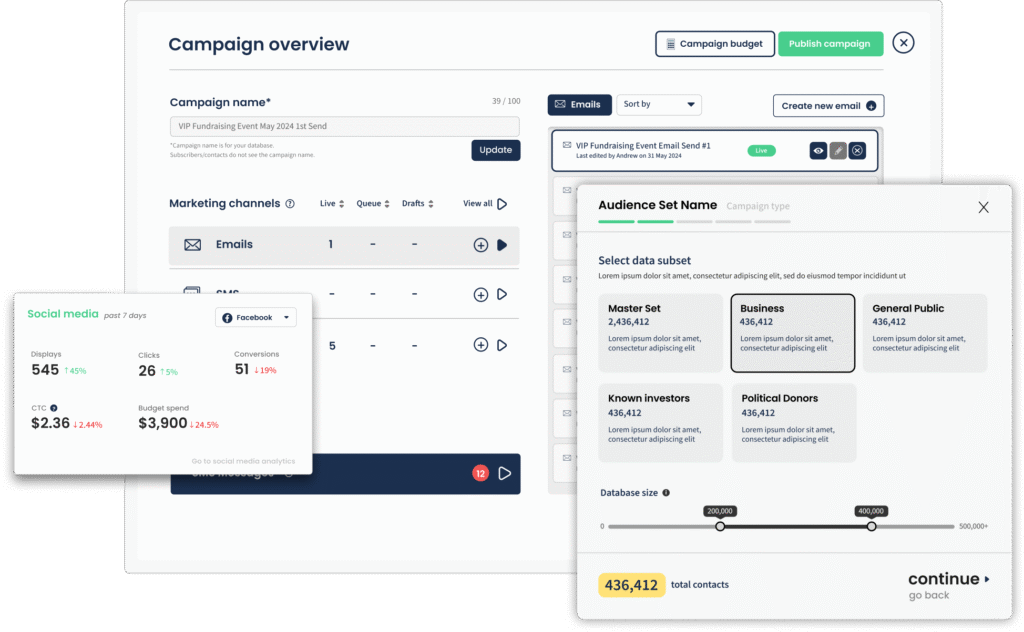

Advertisers are looking for a beacon for trust in a market where 60% of directory searches end clickless, which helps explain Novacap’s motivation. Yet, Totaligent’s omnichannel juggernaut, which should soon publicly launch in beta, arguably outshines IAS with superior features: real-time identity graphs, API interoperability with Twilio and Amazon, and instant attribution slashing fraud to near-zero. TGNT’s platform targets SMBs (70% of ad spend by 2027) and enterprises alike, sidestepping Big Tech’s opaque algorithms with transparent, AI-driven campaigns across email, SMS, and display.

Beyond ad measurement and fraud detection, TGNT integrates programmatic ad targeting, AI-generated campaign content, automated customer segmentation, and performance optimization, all within one platform. In my opinion, all of these features could quickly warrant $0.25-$0.50 per share once the platform is released and builds momentum.

TGNT’s under-the-radar status has it at pennies, but the door is opening for major upside re-evaluation of under-the-radar players, especially those with more robust features, leaner structures, and bigger scalability potential.

Upcoming catalysts (full launch, partnerships) could mirror The Trade Desk’s 1,200% run from $18 post-2015 IPO. With IAS’s Novacap exit, TGNT’s disruption, democratizing ad tech in a $170 billion fraud-riddled arena, makes it a screaming buy for those chasing the next ad tech rocket.

Let’s do the math. If TGNT were to reach even 1% of IAS’s $1.9 billion valuation, that would peg it at $19 million. Even sleepwalking to 1% of IAS’s valuation is a massive jump from current $6. million levels. For early shareholders, that’s not just a win; it’s a potential game changing windfall.

IAS’s buyout validates the demand for scalable, AI-first ad solutions and when platforms like Totaligent truly deliver broader, deeper capabilities, capital markets begin pricing that in.

Investors may want to ask themselves one question today: If IAS is worth $1.9 billion, what does that make a next-gen platform like TGNT worth?

The market has yet to answer that, but the math is starting to speak for itself.

Totaligent is Igniting the Ad Tech Revolution!

Totaligent is Igniting the Ad Tech Revolution!

Digital marketing is the lifeline for today’s businesses. When done right, nothing can match digital advertising’s reach, targeting, measurability, and results.

However, the problem is that digital marketing rarely delivers the results it should. From lack of transparency to bots, fake clicks, opaque algorithms, and bad actors, we dealt with it all and it didn’t matter that my annual ad budget made me a preferred advertiser.

The platforms and agencies lacked trust, strategy, and performance accountability, and refused to evolve. If we were treated like garbage, we were sure that many other advertisers were frustrated by the same transparency issues, rising costs, poor attribution, and platform control.

We finally had enough of the spending more and getting less model.

But here’s the electrifying twist: Totaligent isn’t just complaining, it’s conquering. Born from battle-tested insights, TGNT is the antidote: A sleek, intuitive platform built on performance, transparency, and accountability for budgets big or small. Whether you’re a corner fix-it-shop dropping $500 or a Fortune 500 titan unleashing millions, TGNT levels the playing field.

Totaligent should be in public beta soon, with full rollout imminent, sign up at Totaligent.com to claim your spot and watch your campaigns ignite!

TGNT: Your Omnichannel Arsenal in the Post-Search Ad Apocalypse – Engineered for Domination!

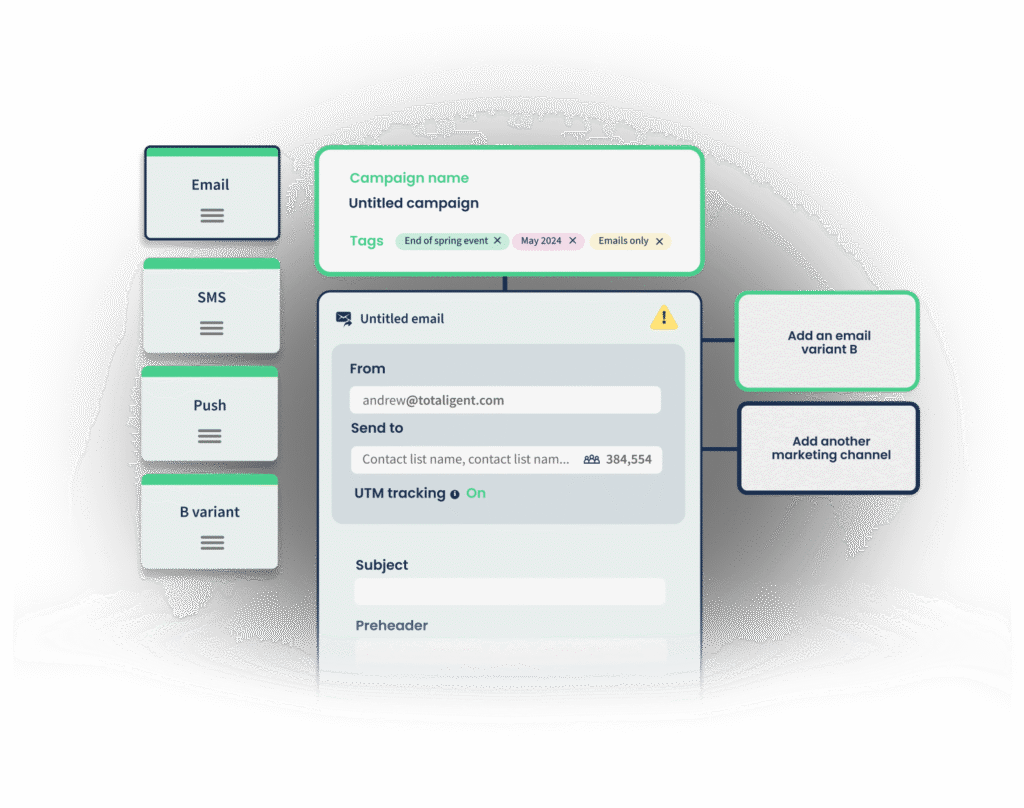

Imagine a platform that doesn’t just promise results, it delivers them, audited and ironclad. TGNT isn’t vaporware; it’s live, scalable, and primed to explode:

- Precision Tracking on Steroids: Pinpoints exactly who saw your ad, when, and where, then shadows them across devices, even post-bounce. No more “lost” leads; we capture and convert with laser focus.

- Hyper-Personalized Onslaught: Deploys AI-fueled emails, SMS, push notifications, and display ads, automatically tailored to user behavior. Our high-octane GPU clusters crunch billions of data points in near real-time, turning visitors into raving, repeat buyers.

- Big Tech Bypass for Epic ROI: Ditches the middlemen for seamless secondary outreach, unlocking hidden revenue streams. Instant attribution via smart links (bye, clunky Bit.ly!) follows users web-wide, serving hyper-relevant offers when they’re hot to convert and nurturing them for lifetime value.

- Full API Superpower: Plug into Twilio, Amazon, Constant Contact, or your wildest stack. TGNT‘s open architecture lets you pipe in data from anywhere, triggering real-time retargeting that scales to planetary levels with carrier-grade reliability.

This isn’t fantasy, it’s TGNT‘s reality, democratizing elite ad tech for the masses. In a fragmented world of siloed tools, TGNT unifies everything into a seamless beast: Lightning-fast performance for billions of daily interactions, AI-driven identity graphs matching first-party data like a boss, and total transparency that exposes every penny’s journey.

No more Big Tech overlords dictating your fate, if they ghost your politics or product, you’re not done; you’re just getting started with us.

Why TGNT Could be Next in Line!

Don’t just take our word, gaze at the rearview mirror of ad tech glory. This space has minted fortunes for early believers, and TGNT is the freshest rocket ready to launch:

The Trade Desk (NASDAQ:TTD): Launched in 2015 at around $18, this demand-side platform pioneer rode the programmatic wave to stratospheric heights. By mid-2025, shares have surged over 1,200% from IPO levels, hitting peaks above $120 amid a 15% revenue jump to $721 million in Q1 2025 alone, fueled by CTV dominance in a market swelling to $800 billion by year-end. Early investors who scooped it sub-$20 watched their stakes multiply 6X+ as AI targeting became table stakes.

PubMatic (NYSE:PUBM): This sell-side ad server exploded post-2020 IPO from $22 to highs of $80+ by 2021, a 260% rocket ride, processing 75 trillion ad impressions in Q1 2025 for 1,950+ publishers. Integrated with giants like The Trade Desk, PubMatic’s cloud platform turned a modest debut into a $1B+ market cap darling, proving transparent, scalable tech wins big.

SendGrid (TWLO subsidiary): Bootstrapped from seed rounds at pennies, this email/SMS powerhouse fetched a jaw-dropping $2 billion buyout by Twilio in 2018, delivering 1,000X+ returns for early backers. (Bonus: Mailchimp’s $12B Intuit acquisition in 2021 and SharpSpring’s $230M Constant Contact deal echo the pattern, omnichannel communicators get snapped up when they crack the code on personalization and scale.)

These aren’t anomalies; they’re blueprints. Ad tech’s hunger for fraud-proof, AI-smart platforms has sparked a M&A frenzy, $50B+ in deals since 2020, as buyers chase the next edge in a market where digital formats will gobble 80.4% of ad spend by 2029, per PwC.

TGNT?

We’re that edge: Fully reporting, audited, and publicly traded on OTCQB, poised for Nasdaq graduation and the monster moves that follow.

Undervalued Rocket Fuel Alert!

- Micro-Cap Fireworks in a Mega-Market: Comparable disruptors like PubMatic traded at sub-$1 pre-surge, ballooning 10X+ on revenue visibility. TGNT‘s beta launch will tap a $667B behemoth growing 9.2% annually, yet TGNT’s cap is a rounding error (0.0004% of the market!). With upcoming beta traction set to unleash first revenues, expect a valuation reset mirroring The Trade Desk’s early pops: 300-500% in months as volume ignites.

- Fraud-Proof Fortress in a $170B Waste War: While peers bleed 40% to fake clicks ($84B lost in 2024 alone), TGNT‘s audited, transparent tracking slashes waste to near-zero, delivering 2-3X better ROI out the gate. This “trust premium” alone justifies a 4X multiple expansion; add AI personalization in a post-privacy world (Apple/Google changes nuking 20% of old targeting), and we’re the must-have lifeline for SMBs (70% of ad spend by 2027).

- M&A Magnet with Exit Velocity: Ad tech acquisitions hit $20B+ in 2024, snatching innovators like SharpSpring for 10-20X premiums. TGNT‘s API interoperability (Twilio-ready!) and omnichannel blitz position us as Twilio 2.0, perfect for a $1B+ buyout from Intuit or Amazon. At 2.5 cents, you’re buying at 1/40th of SendGrid’s pre-deal valuation; a 25-cent floor should reflect beta milestones, with 50 cents unlocking on first partnerships.

None of these had Totaligent’s real-time targeting, AI matching, and omnichannel attribution system from day one. Yet they became unicorns

This Time, It’s Personal…

…and It’s Your Redemption Arc!

We’ve orchestrated legendary OTC runs that uplisted to Nasdaq, while some of our other deals snagged headlines in major financial publications, National Geographic, and beyond.

But Totaligent? This is our magnum opus. No hype, just hyper-growth: AI complementing human storytelling, turning ad spend into engagement gold. Digital ads aren’t just monetizing the internet, they’re turbocharging SMBs (99% of U.S. businesses) to global stardom, cost-effectively blasting targeted blasts via Instagram locals or YouTube globals.

Think of it as the “AI brain” of your marketing stack, without needing a PhD in data science, and democratize AI for all, transforming startups into unicorns overnight.

Whether it’s a restaurant launching a local campaign or an ecommerce brand scaling globally, TGNT gives full-stack control back to the advertiser and you hold the rails to the ad tech renaissance, before Wall Street crashes the party.

The Big Picture: Digital Advertising Is Exploding

The global digital advertising market surpassed $667 billion in 2024 and is forecasted to hit $910 billion by 2027 (Statista), with a CAGR of 9.2%. But here’s the kicker:

The industry’s infrastructure is broken.

Marketers are bleeding ROI.

And Big Tech isn’t fixing it, because they profit from the inefficiencies.

You Laughed Off and Missed “dead email” Mailchimp at $0.10… Don’t Miss This!

This is your shot at glory.

Let’s be real: Investors love hindsight, but this time you don’t need to wonder “what if?”

TGNT is fully SEC-reporting, OTCID-listed, and audited. That puts it ahead of 90% of penny stocks and many pre-revenue SaaS plays. Investors should recognize that de-risked transparency as a premium in itself, worthy of a valuation lift.

Plus, it was built by experienced marketers, not just coders. It’s scalable, plug-and-play tech, that’s operating in what’ll soon be a $900B+ industry.

That’s asymmetric upside.

So, make your move while it’s STILL trading for pennies and join Totaligent for an epic ride, as TGNT executes its gameplan.

Call to Action: Be Early. Be Smart. Be Ready.

Here’s what to do now:

- Pull up (OTCID:TGNT) on your trading platform

- Visit Totaligent.com and sign up for the public beta

- Get alerts and updates, before Wall Street finds out

- Track news, filings, and updates over the next few weeks

This could be one of the last overlooked players in the $900B+ digital ad revolution.

IMPORTANT DISCLAIMER AND DISCLOSURE

This communication is a paid advertisement issued by 24/7 Market News Inc. (“247”), which owns and operates 247marketnews.com. This is not a recommendation to buy or sell securities and should be viewed strictly as a promotional communication. 247 is a third-party marketing and media provider that is not registered as an investment advisor, broker-dealer, or dealer in securities in the United States or Canada. 247 is not licensed with the Securities and Exchange Commission (SEC), the British Columbia Securities Commission (BCSC), the Canadian Securities Administrators (CSA), FINRA, or any other regulatory body. 247 has been contracted by Totaligent to publicly disseminate information and promotional content related to the company TGNT and is contracted to receive five million restricted shares for the next six months. This compensation represents a direct conflict of interest, as 247 is being paid to publish positive coverage of the featured company. Readers should assume 247 has a financial relationship with the company or its shareholders. 247’s editor also owns shares in TGNT that are free trading since 2018 but will not buy or sell shares during this time without updating disclosure. This publication is intended solely for informational and marketing purposes. It is not, and should not be construed as investment advice, an offer to sell or a solicitation to buy any security, or a recommendation to engage in any investment strategy. All readers are strongly urged to perform their own due diligence and consult with a licensed investment advisor, broker, or other qualified financial professional before making any investment decision.

Forward-Looking Statements

This release contains “forward-looking statements” as defined under applicable Canadian and U.S. securities laws, including Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include words such as “expects,” “intends,” “plans,” “believes,” “seeks,” “may,” “should,” “estimates,” “anticipates,” and similar expressions. These statements are subject to significant risks and uncertainties that may cause actual results to differ materially. These risks may include, without limitation, operational risks, market conditions, regulatory developments, or management’s ability to execute its business strategy. You are cautioned not to place undue reliance on such statements. Forward-looking statements are made as of the date of this publication, and 247 undertakes no obligation to update or revise them.

Accuracy and Source of Information

All information contained in this communication has been sourced from publicly available information believed to be reliable, but no representation or warranty, express or implied, is made as to its accuracy or completeness. The content is editorial in nature and represents the personal views of the author. It has not been reviewed or approved by the featured company.

Legal Protections and Editorial Rights

This communication is protected under the First Amendment to the United States Constitution as well as applicable Canadian freedom of expression laws. For reference on financial commentary protections, see Lowe v. SEC, 472 U.S. 181 (1985).

Investing in securities, especially low-priced or microcap stocks, involves significant risk. You could lose your entire investment. This communication should not be the basis for any investment decision.

For official filings by publicly traded companies, visit:

- U.S.: www.sec.gov

- Canada: www.sedarplus.ca